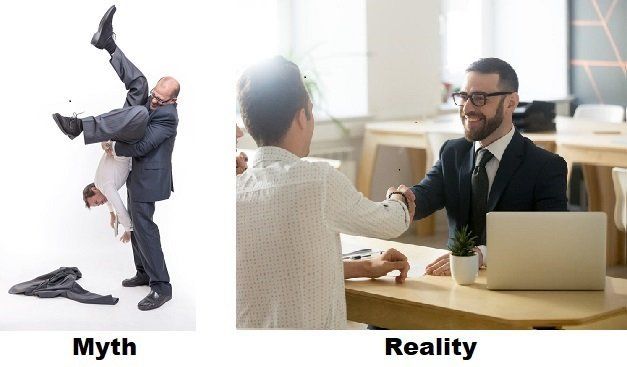

Truth or Fiction? Debunking Debt Collection Myths

Don't Be Put Off by These

Collection Agency Fables

Collection agents are “shake-down artists.”

Collection agents don’t care if you lose customers, as long as they get paid.

Collection agents will knock on your customer’s door and threaten him.

Collection agents will force your customers into bankruptcy.

If you’re a business owner considering engaging a debt collection agency for your overdue accounts receivable, you may be put off by some of these common myths. (Who wouldn’t be?!)

Well, we’re here to debunk those myths and separate the fact from fiction.

Myth #1: Debt collectors continually hassle people who cannot pay.

Fact: Harassment of a consumer is not only ineffective, it’s illegal. The Fair Debt Collection Practices Act (FDCPA) ensures that debtors are not harassed or threatened in any way. Any debt collector who violates the FDCPA can be sued in state or federal court for damages and legal fees.

Instead of coercive tactics, reputable debt collectors are trained to listen to what consumers say and determine if they actually have the resources to pay the past-due bill.

Myth #2: My customers can go to jail if they don’t pay the collection agency.

Fact: Fortunately, debtors’ prisons are a thing of the past. Your customers won’t go to jail if they don’t pay back their debt.

Any debt collector who threatens a customer with criminal charges or jail time is doing so illegally. No reputable collection agency would ever resort to such tactics. (Failure to pay taxes or child support, or failure to appear for a debtor’s examination can result in jail time, but these situations are not relevant to the vast majority of consumer debts.)

So, don’t worry—your customers will not be arrested for failure to pay their debt to you.

Myth #3: A debt collector will knock on my customer’s door.

Fact: While the media has perpetuated the image of the debt collector knocking on doors to collect debts, in reality, they almost never resort to such measures. It simply isn't efficient (or effective). With today’s modern technology, debt collectors can make hundreds of contacts a day—many more than by going door-to-door.

So you needn’t worry that collection agents will be paying a visit to your customer’s home.

Myth #4: Debt collectors force people into bankruptcy.

Fact: When debtors file for bankruptcy, virtually all of their unsecured debts are wiped clean. Both the original creditor and the collector receive little or nothing.

So it simply would not make sense for a debt collector to encourage a consumer to file for bankruptcy. Debt collectors understand that people in financial trouble often need guidance in settling their accounts, as well as the flexibility of alternative payment arrangements.

While it’s true that a debt collector's business is to collect, collecting often includes counseling. Their ultimate objective is to resolve the debt, which is why they’ll recommend payment plans and other programs to help the debtor.

Myth #5: Collection agency business booms during economic hard times.

Fact: It may be true that more accounts are placed with professional collection agencies economic recessions, but it’s also true that those accounts are less collectible. When consumers are unemployed for long periods of time, and businesses are struggling, bills don’t get paid.

But a prolonged recession also results in fewer accounts sent for collection. The bottom line: Collection agencies, like everyone else, prefer a healthy economy.

Myth #6: Debt collectors are a special breed of people.

Fact: Debt collectors come from all types of backgrounds all types of experiences. They are trained to be quick thinking, goal oriented, problem solvers who can communicate effectively. Tact, persistence and an understanding of people's motivations are all traits of a good debt collector.

Myth #7: Hiring a collection agency is expensive.

Most collection agencies work on a contingency basis.

If they don’t collect, you don’t pay. And while the agency will keep a percentage of the amount collected, paying them is still less expensive than not getting paid at all.

Myth #8: Businesses that use collection agencies lose customers.

Using illegal tactics—like threats or harassment—could very well lose you customers. But a good collection agency would never resort to such measures. As stated above, professional debt collectors are trained to resolve problems, not contribute to them. Utilizing a reputable debt collection agency should never cost you customers, and it should also never harm your business’ reputation.

Recent Posts

Share On: