Getting Paid on Workers' Comp Claims

Workers’ Compensation Can Be a

Big Headache for Healthcare Providers

Collecting on workers’ comp claims is an exasperating exercise for healthcare providers. While these claims represent only a small percentage of a practice’s total A/R, they can present some of the biggest headaches.

What with different terminology, numerous logistical hoops, and specialized collection forms, it’s easy for providers to become discouraged when attempting to collect on these claims.

Workers’ compensation is a government-regulated program designed to reimburse lost wages and medical costs for work-related injury or illness. Although it may resemble standard health and disability insurance programs, it's quite different when collecting on claims.

Iowa’s Work-Related

Injuries

According to the Bureau of Labor Statistics, more workplace injuries and illnesses are reported in Iowa each year than the national average. In 2020, Iowa-based private industry employers reported 34,000 nonfatal workplace injuries and illnesses, resulting in an incidence rate of 3.3 cases per 100 FTE workers.

Iowa was among 20 states that had an incidence rate significantly greater than the national rate of 2.7 cases per 100 FTEs. The state’s higher-than-average incidence rate has remained consistent over the past several years.

Iowa industries with the most work-related injuries and illnesses were manufacturing and health services.

Rules Upon Rules

Standard commercial health insurance basically uses the same rules, processes, and procedures for each claim. Workers' comp, on the other hand, varies by state: fifty states, 50 different ways of handling claims.

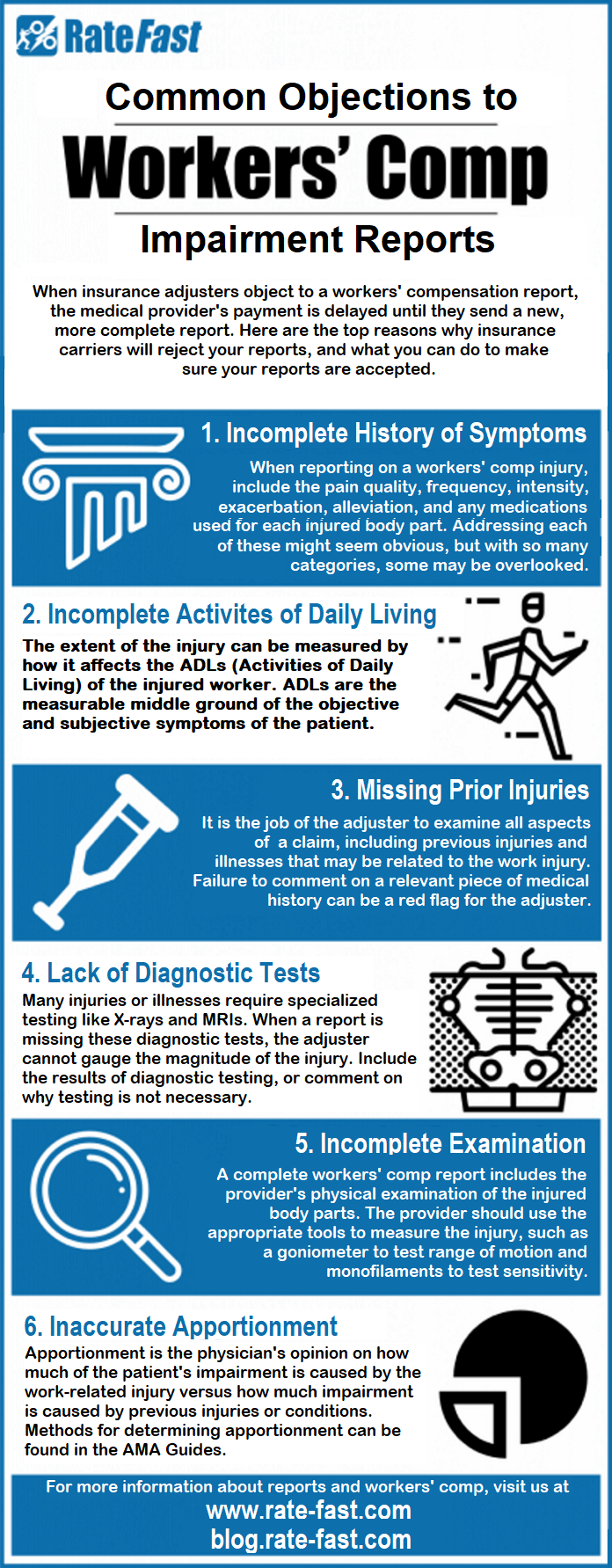

The result is a myriad of fee schedules, rules, reports and treatment plans that providers must understand in order to follow the rules precisely. Failure to do so will likely result in a rejected claim.

Not Your Typical

Insurance Claim

Worker's compensation is highly specialized. Insurance companies that offer it do not sell standard plans, and traditional insurance carriers don't provide worker's comp. Healthcare providers who submit worker’s comp claims to the wrong payer or administrator risk violating state filing requirements.

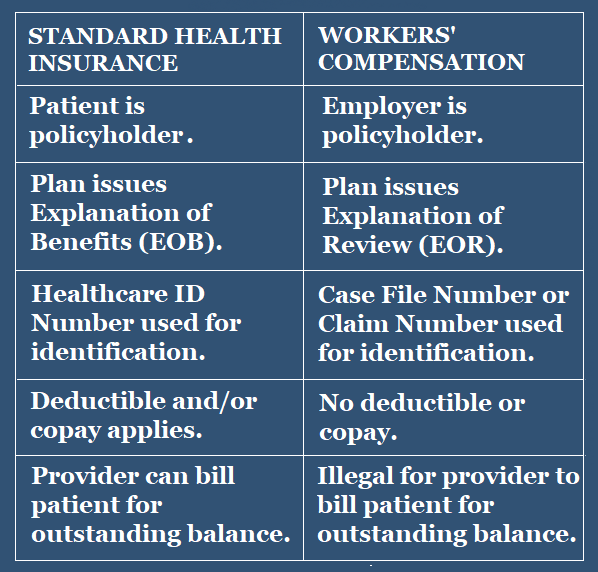

These claims also require an understanding of the program’s special terminologies and unique collection forms. For example, in the world of standard health insurance, the patient is typically the policyholder. Not so in the workers’ comp world, where the patient’s employer is the policyholder.

In the workers’ comp world, the explanation of benefits (EOB) becomes an explanation of review (EOR). Claims are identified by claim or case file number instead of healthcare ID. There’s no deductible or copay linked to the worker’s comp claims.

More importantly, providers must accept compensation paid through workers’ comp as payment in full. Billing patients for any outstanding balance is illegal.

Before filing a claim under workers’ comp, the healthcare provider must obtain a First Report of Injury Form from the patient’s employer. The provider must complete the medical section of this form when the patient first seeks treatment for the work-related injury or illness. Failure to obtain this pre-authorization can adversely impact the reimbursement process.

--Article Continues Below—

Follow-Up Is Critical

Once all the necessary forms and authorizations have been properly prepared and submitted per state requirements, you’ll want to follow up regularly to ensure the timely processing of reimbursement.

After reimbursement, the provider must then check the accuracy of each payment, to ensure the payer is using the correct fee schedule. Any over-payment or under-payment means the provider must promptly file an appeal.

Standard Insurance

vs. Workers’ Comp

Should You Consider Outsourcing?

It’s easy to see how providers may indeed struggle to get paid for workers’ compensation claims. With so many rules and procedures that must be followed to the letter, practitioners could end up losing money in the long run.

But not every aggravating job must be handled internally. There are plenty of healthcare RCM companies that specialize in workers’ compensation claims. Outsourcing may be your best bet if you're devoting too many resources in attempting to collect on these claims. It could minimize problems for your staff while also freeing them up for more meaningful work.

The following healthcare RCM companies specialize in managing workers’ comp claims:

Sources:

Featured Image: Adobe, License Granted

Continuum

Becker's Hospital Review

Thomas, Coon, Newton & Frost

Recent Posts

Share On: