Should Healthcare Providers Request Upfront Payment?

Requesting Upfront Payment

Can Be a Delicate Matter

As 68-year-old Susan Bradshaw lay on a hospital gurney and waited to be wheeled into surgery for an emergency appendectomy, she was approached by the surgeon's office manager.

The woman demanded that Bradshaw pay $1,400 before the surgery could proceed.

"You have got to be kidding," Bradshaw said. "I don't have a credit card on me."

The woman crossed her arms and told Bradshaw she'd have to "figure it out."

This rather shocking

scenario illustrates how NOT to request upfront payment for medical services. But there are plenty of other situations where requesting payment in advance of services is not only acceptable, it can benefit patients as well as providers.

Point-of-Service Collections

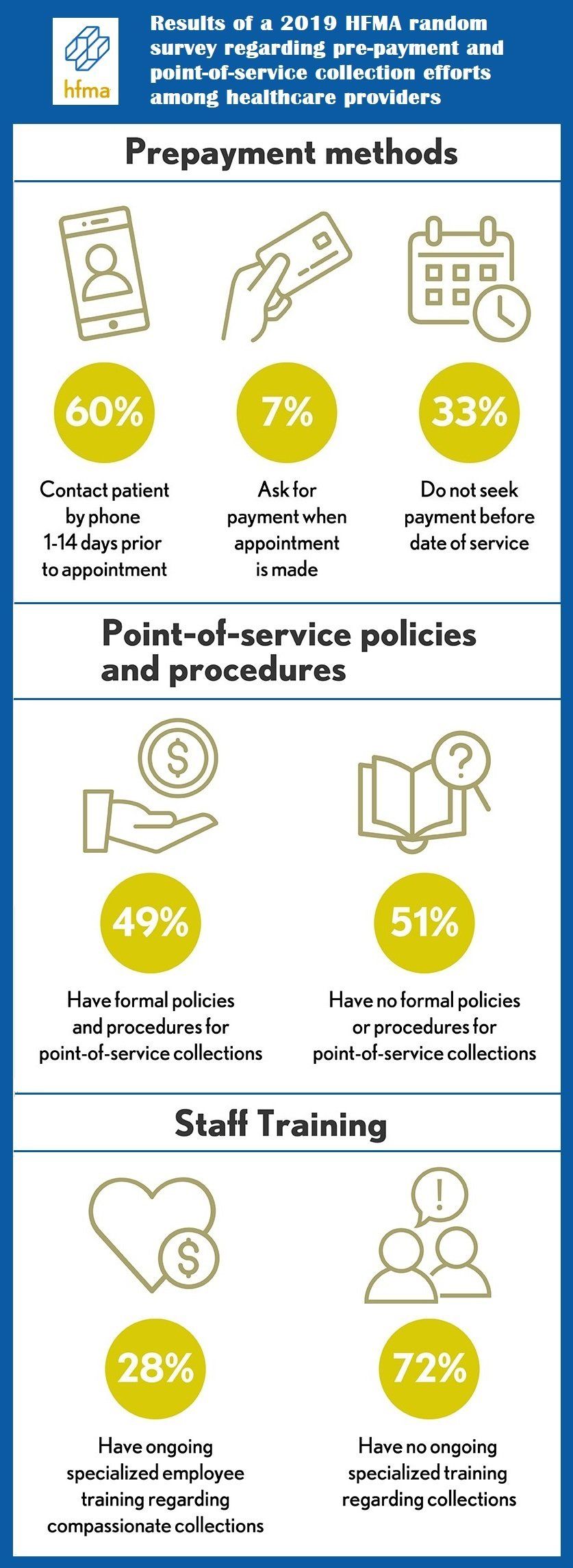

Rick Gundling is Sr. Vice President at the Healthcare Financial Management Association (HFMA). According to him, about three-quarters of all healthcare and hospital systems ask for some payment at the point of service.

Upfront Payment Policy

Make sure your Patient Financial Responsibility Form includes a reference to your upfront payment policy. Explain how your facility or practice operates with regard to point-of-serve payment.

For example:

"We will submit the claim to your health insurance carrier and provide you with a written estimate of your out-of-pocket expenses. Our financial counselors are available to assist you with payment plans."

Often, the amount collected upfront is simply the insurance copayment. But increasingly, healthcare providers are also requesting some or all of the patient’s out-of-pocket expense. Obviously, there's a big difference between seeking a $20 copay and expecting a patient to cover a $2,000 deductible.

Which is why requesting upfront payments requires both technology and training: technology to accurately estimate the patient’s financial responsibility, and training to effectively counsel patients and establish a workable payment plan. (According to a 2016 survey, 53% of patients reported using a payment plan to pay off medical bills.)

Start with Accurate Cost Estimates

A variety of software technologies are available to help healthcare providers estimate total costs for medical services, as well as the patient’s self-pay portion. Typical capabilities include:

- Estimating fees for various treatments, including outpatient, ambulatory surgery center, and physician services.

- Estimating patient expenses based on the provider’s contract with payers, historical inpatient and outpatient procedure charges, and patient insurance information.

- Creating an expense estimation letter to share with patients.

Proper Training Makes the Difference

A personable approach by properly trained staff can make all the difference when it comes to requesting upfront payment for medical services. Staff members should be trained to offer financial counseling to patients who may face difficulty in covering their out-of-pocket expenses.

A large part of financial counselor of patients involves education: taking the time to explain basic medical and insurance terminology, and explaining the expense estimation letter. Then, the counselor and patient together can create a workable payment plan. Also, be sure to advise patients of any financial assistance programs for which they may be eligible.

--Article Continues Below--

Train staff members to suggest multiple payment options, such as:

- Prompt-payment discounts of 20% (considered standard)

- Longer payment periods for high balances

- Flat-rate basic services for self-pay patients

Empathy and compassion are the key to successful upfront financial counseling, particularly in light of the COVID-19 pandemic and subsequent economic fallout. Patients are experiencing very high levels of stress. The job of the financial counselor is to help alleviate that stress, not contribute to it.

Between a Rock and a Hard Place?

As a healthcare provider, you may sometimes feel that you are between the proverbial “rock and a hard place” when it comes to collecting the patient responsibility portion of your payment.

On the one hand, this portion represents a significant chunk of your overall revenue. It must be collected for your practice to remain financially afloat. On the other hand, you’re aware of the negative effect financial stress has on the health of your patients.

With the right technology and properly trained staff, an upfront payment policy can result in fewer bad debts. But in order to be effective without jeopardizing the valuable patient relationship, this policy must be based on compassion, applied tactfully, and include patient financial counseling.

Recent Posts

Share On: