Why Isn’t My Patient Paying This Bill?

The Many and Varied Reasons for

Non-Payment of Debt

There are multiple reasons why your patients may not be willing or able to pay their medical bills. These reasons typically fall into four categories: Circumstantial, Emotional, Intellectual and Criminal.

Let’s explore each.

Circumstantial

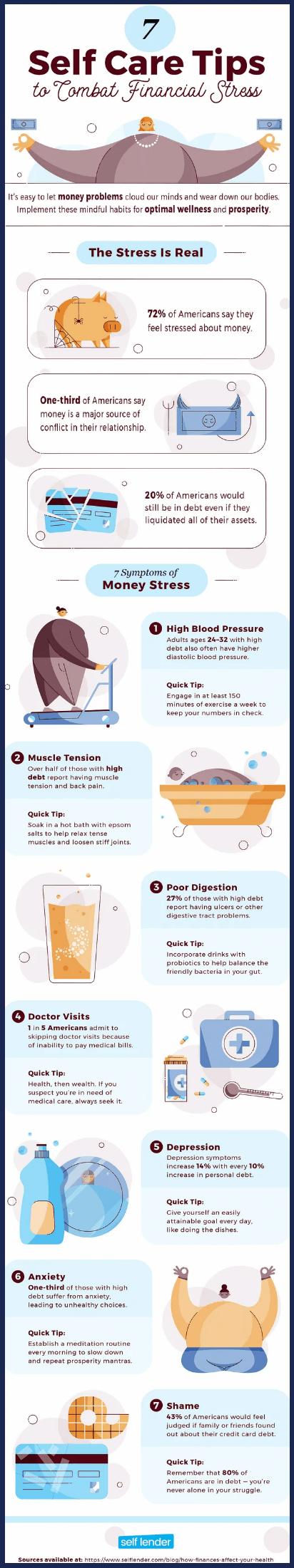

The vast majority of patients with overdue accounts belong in this category. These patients may want to pay their medical bills, but they’ve fallen on hard times. Consumers in all walks of life have been adversely impacted by the COVID-19 pandemic and its economic aftermath.

Empathy goes a long way when trying to connect with these patients. Effective medical collectors will first listen to the their stories and gather as much information as possible. Then – together with the patient – they can devise a payment plan.

Patients Delaying

Healthcare

A 2018

CarePayment

survey revealed the various ways consumers are neglecting their healthcare needs due to financial stress. Specifically:

- 61% of Americans have no money saved to cover their healthcare expenses.

- 64% have avoided or delayed medical care in the last year due to expected costs.

- 44% would not receive needed medical care, even if it put their health at risk, if their out-of-pocket expenses would exceed $500.

- 69% of those surveyed reported that their deductible was at least “somewhat difficult” to afford, with 22% reporting “very difficult” or “impossible.”

It also helps to remind these patients that their current financial situation is temporary.

Emotional

Patients are sometimes ruled by their emotions, blaming their debt on other people. When patients fail to take ownership of their situation, they may either deny the debt or become angry about it.

Debt Denial

Indications of debt denial include:

- Underestimating the amount owed.

- Refusing to answer collection calls.

- Refusing to open bills or stuffing them in a drawer.

Unfortunately, this kind of behavior only leads to more debt with the accruing of interest charges and late fees. Emotional patients rationalize their mistakes as a way to protect their egos. But reality always sets in, sooner or later.

Debt-Anger Syndrome

Rather than panic or deny, these patients get mad.

They’re angry with the healthcare providers who continually send them bills. They’re angry with the postal carrier who delivers those bills. They’re angry with their employers for not paying them more. They’re angry with their spouses, their kids and themselves. They’re basically just mad at life.

Angry patients need to know that, once they have a plan to dig out of their financial hole, they can start feeling better right away.

Intellectual

Intellectual patients are often disorganized. They may possess a higher degree of education, but have little understanding of finances. In the grand scheme of things, their debts may seem trivial to them. Showing them why they owe the debt in the first place is often helpful.

It’s often fairly easy to encourage intellectual patients to the account right away.

--Article Continues Below--

Criminal

There’s no proven method for identifying patients who have no intention of paying their bills. However, the number of accounts and types of debts the patient incurs might provide a hint about his intentions.

For instance, substantial medical debt usually isn’t a red flag. But if the patient also has excessive credit card debt, that could indicate a pattern.

Are You Offering Multiple Payment Options?

The more payment options you offer your patients, the greater your chances of being paid. Here are a few you may wish to consider:

- Co-branded, personalized financing services for healthcare providers (such as AccessOne or CarePayment).

- Prompt-payment discount (e.g. 10 to 20 percent) for paying within a certain time frame.

- Increased payment periods for patients suffering through hard economic times.

- Prepayment arrangement for large, planned medical expenses such as childbirth.

- Basic services offered at a flat rate to uninsured or other self-pay patients.

- An online payment portal that’s easily accessible via mobile device.

Overcoming Objections

There are steps you can take to overcome patient objections to paying their bills. Reputable collectors often can move quickly to resolving an overdue account by putting the consumer at ease.

Professional collectors will:

Validate the patient’s feelings. If the patient is feeling anxious, hopeless, or angry, a reputable collector will listen and express empathy.

Help the patient feel better about the situation. Patients’ financial hardships are almost always temporary. Remind them of that. Help them to recognize that the creditor and collector are not their enemies, but rather their allies – working together to resolve the debt.

Let the patient know what can be done to help. Offering a flexible, zero-percent interest payment plan should be central to possible solutions. In fact, Journal of Health Care Finance has indicated that such payment arrangements not only allow patients to pay their medical bills, but also result in public health benefits and contribute to the financial well-being of care providers.

For example, compared to patients without access to affordable payment plans, patients with zero-interest plans are:

- Less likely to avoid medical care because of the cost, and

- Better able to pay for necessities like food or heat.

Need Help?

Would you like to offer alternative payment plans to your patients, but don’t know where to start? The medical collection professionals at CBSI can help. Contact us today!

Recent Posts

Share On: