Regulation F to Take Effect November 30

What You Need to Know

About the New Rule

As discussed in our last article, Regulation F, the first major update to the Fair Debt Collection Practices Act, is scheduled to take effect on November 30 of this year. Here’s a recap of the new rule and what we will need from our clients:

Electronic Communications

- Debt collectors may contact consumers via email and text messaging, but only if given expressed or implied consent to do so.

- Every text or email sent by a debt collector must contain a clear and conspicuous “opt-out” notice.

Telephone Communications

- Debt collectors may not attempt to call a consumer more than seven times within seven consecutive days.

- Debt collectors are limited to one debt-related conversation with a consumer within a seven-day period.

Validation Notice

Regulation F requires three changes to the debt validation notice.

- The notice must specify a particular date on which the validation period expires.

- The notice must provide the website address for the Consumer Financial Protection Bureau (https://www.consumerfinance.gov/consumer-tools/debt-collection/).

- The notice must include an itemization date.

What We Will Need From You

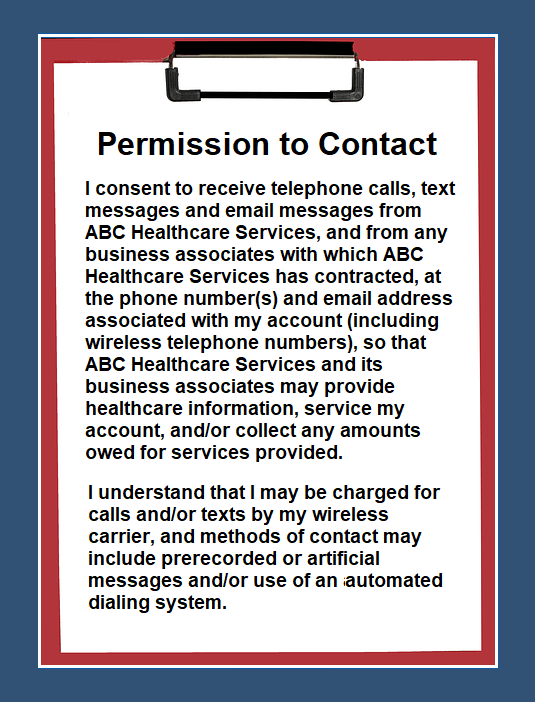

Permission to Contact

Please incorporate “permission to contact” language on your patient intake form, including a reference to collecting payment for services provided. (See form at left, “Permission to Contact,” for suggested language.)

Itemization Date

At CBSI, we will be using the last date of service (DOS) as the required itemization date. As of November 30, 2021, we will need the following:

- The account balance on the last DOS, even if it is the same as the account balance at the time of placement with us.

- Separately itemized interest charges and fees. (If you are charging these, please reach out to our office to discuss. New limitations on these charges require proper disclosures and/or agreement.)

- The placement amount. (This would be the DOS balance minus the total amount of consumer payments, write-offs, credits or insurance payments credited to the account.)

Client Portal

When entering account information on our Client Access Web Portal, you must now enter the amount due on date of service, interest, fees and placement amount. You must complete each field, even if the amount is zero.

Placement Files

Clients using placement files will need to add an additional field for the account balance as of the last date of service.

As always, if you have any questions about Regulation F and its potential impact to your business, please do not hesitate to contact us.

Sources:

Featured Image: Adobe, License Granted

Consumer Financial Protection Bureau

InsideARM

American Bar Association

Recent Posts

Share On: