Regulation F: What’s It All About?

New Debt Collection Rule Clarifies FDCPA,

Addresses Electronic Communications

(The following is provided as an overview of the new regulation,

and is not intended to be a full and exhaustive explanation.)

In recent months, there’s been a lot of buzz around the collection industry about new legislation known as “Regulation F.” What exactly is it, and how will it affect your business? Let’s start with some background information...

The Consumer Financial Protection Bureau (CFPB) was established in 2010 for the purpose of enforcing federal consumer laws – including the 1978 Fair Debt Collection Practices Act (FDCPA).

In late 2020, after many years of extensive work and lengthy commentary, the CFPB issued Regulation F, its long-awaited revision to the FDCPA. Currently scheduled to become effective early in 2022, Regulation F is the first major FDCPA update in 40 years. The new rule was published in two parts, both of which focus on debt collection communications.

Part 1 - Communication Technologies

Part 1 of the new rule, published in October of last year, consists of 653 pages. It addresses the use of new communication technologies (text, email and social media) to collect a debt, and it sets restrictions on telephone communications. In doing so, Regulation F establishes guidelines that provide a “safe harbor” to debt collectors.

Email Messages

Debt collectors may contact consumers via email if the person’s email address was obtained and used by the original creditor to communicate with the consumer about the account. However, the creditor must send advance notice to the consumer (via written or electronic communication) regarding the debt collector’s future email communications.

Consumer Preferences

Are Key

Under Regulation F, attempting to communicate with a consumer about a debt using a method he or she has requested NOT be used -- or for which he or she has opted out -- is considered to be "harassing, oppressive or abusive conduct," and is strictly prohibited.

Text Messages

Debt collectors may contact consumers via text messages, but only if the consumer has expressed or implied consent to do so. In addition, debt collectors must reconfirm said consent every 60 days by utilizing a complete and accurate database to verify that the consumer’s cell phone number has not been reassigned.

Social Media Messages

Debt collectors are not prohibited from using a consumer’s social media channels in an attempt to collect a debt.

However, they are prohibited from using social media communications that are viewable by the general public or by the consumer’s social media contacts.

Opt-Out Notices

Every text or email sent to a consumer by a debt collector must contain a clear and conspicuous “opt-out” notice. The method for opting out of further such communications must be simple and reasonable, no fees may be charged for opting out, and no additional information may be solicited other than the consumer’s communication preference.

Telephone Communications

The first wave of Regulation F also addresses telephone communications, setting restrictions on the number of times a debt collector may attempt to call a consumer regarding a debt. Specifically:

- Debt collectors may not attempt to call a consumer more than seven times within seven consecutive days. Limited-content messages, voicemails, and ringless voicemails are all considered attempts to call. In other words, any placed and connected call is considered an attempt to call.

- Debt collectors are limited to one debt-related conversation with a consumer within a seven-day period.

Part 2 – Model Validation Notice

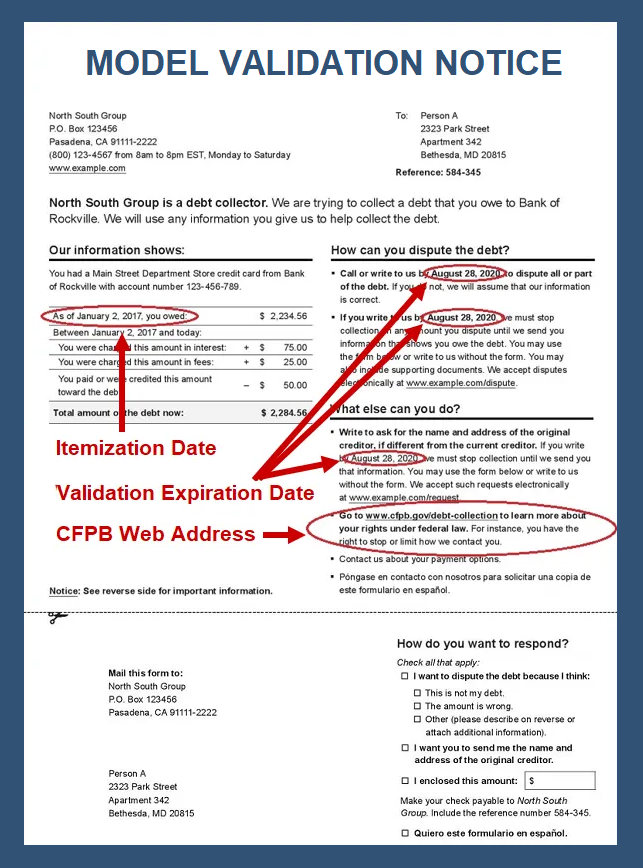

Part 2 of Regulation F, issued in December 2020, focuses primarily on the Model Validation Notice.

The FDCPA already requires that debt collectors send a validation notice to consumers within five days of initiating contact with a consumer about his debt.

Regulation F clarifies the type of information which this notice must include and provides a model for creditors and collectors to use. There are three particular changes which Regulation F requires for validation notices. (These changes are indicated in the graphic below.)

1. Instead of stating that the consumer has 30 days to dispute the debt or request more information about the debt, collectors must now specify a particular date on which the validation period expires.

2 . The notice must inform the consumer that additional information about consumer protections is available on the CFPB’s website, and the website address must be included.

3 . The notice must include an itemization date, which the CFPB defined as one of five reference dates a debt collector can use to determine the amount of the debt:

- The date of the last statement that was provided to the consumer by a creditor;

- The date the debt was charged off;

- The date the last payment was applied to the debt;

- The date of the service or other transaction for which the debt was incurred; or

- The date of a final court judgment with regard to the debt.

What It All Means to You

Debt collectors rely on their creditor-clients to provide the account information which the collection agency must disclose to the consumer. Once Regulation F becomes effective, it will be even more important that creditors provide collectors with certain information to help expedite collection under the new rule.

Permission to Contact

For instance, it's a good idea to incorporate “permission to contact” language on your patient intake form. This language should include a reference to collecting payment for services provided. Here’s a suggestion:

I consent to receive telephone calls, text messages and email messages from [YOUR BUSINESS NAME], and from any business associates with which [YOUR BUSINESS NAME] has contracted, at the phone number(s) and email address associated with my account (including wireless telephone numbers), so that [YOUR BUSINESS NAME] and its business associates may provide healthcare information, service my account, and/or collect any amounts owed for services provided. I understand that I may be charged for calls and/or texts by my wireless carrier, and methods of contact may include prerecorded or artificial messages and/or use of an automated dialing system.

Also, if you want us to contact your consumers via email, Regulation F requires that you notify them in advance that we will be sending them email communications.

Itemization Date

As outlined above, the “itemization date” which is used to ascertain the amount of the debt – and which must be included on the validation notice -- can be one of five possible dates.

At CBSI we believe the transaction date (i.e., date of service) would be the most reasonable date to use. So once Regulation F becomes effective, here is what we will need from you for each account:

In this way, you can help ensure that our debt recovery efforts on your behalf can continue to exceed your expectations. As always, if you have any questions about the new legislation and its potential impact to your business, please do not hesitate to contact us.

Sources:

Featured Image: Adobe, License Granted

Consumer Financial Protection Bureau

InsideARM

Recent Posts

Share On: