The Power of Credit Reporting

Credit Reporting Is a Powerful Tool

That Must Be Used Responsibly

Jonathan receives a tentative job offer from a great company that will provide a good salary and generous benefits.

But before his hire date, the employer retracts the offer. Jonathan later learns that collection accounts on his credit report were the culprit.

Who’s Looking?

Who looks at credit reports anyway?

There was a time when only lenders and financial institutions ran credit reports. Not anymore. In today’s world, employers, insurance companies and utility companies also use credit reports and credit scores when making decisions about consumers.

In fact, according to a 2012 report by the

Society for Human Resource Management, about 45% of mid-sized companies perform background credit checks on their job applicants. (Note: Employers do not have access to consumers’ credit scores, but instead see a modified version of their credit reports.)

These credit checks provide employers with insight into a potential new hire, such as:

- Lots of late payments could indicate a lack of organization and/or responsibility.

- Excessive debt can be a sign of financial distress, which could indicate a risk of theft or fraud.

- Mishandling of finances could indicate a poor fit for a job that involves company funds.

That’ll Cost You

While a high credit score can open doors and lower interest rates and premiums, a low credit score will have the opposite effect. And just one collection account can cause a good credit score to drop 50 to 100 points.

A negative credit report can cost a consumer a small fortune in interest on a car loan. But did you know it can also increase his insurance premiums?

Take auto insurance, for instance. Insurance carriers base their premiums in part on credit scores because, statistically, drivers with lower credit scores file claims more often.

So these drivers pay more right from the start. In fact, according to The Zebra's 2019 "The State of Auto Insurance" report, “Drivers with poor credit pay more than twice as much for car insurance as those with exceptional credit.”

There are two ways bad credit can affect a consumer’s ability to rent an apartment:

- The landlord may favor applicants with better credit ratings.

2. If approved, the landlord may require a significantly larger security deposit.

Knowledge Is Power

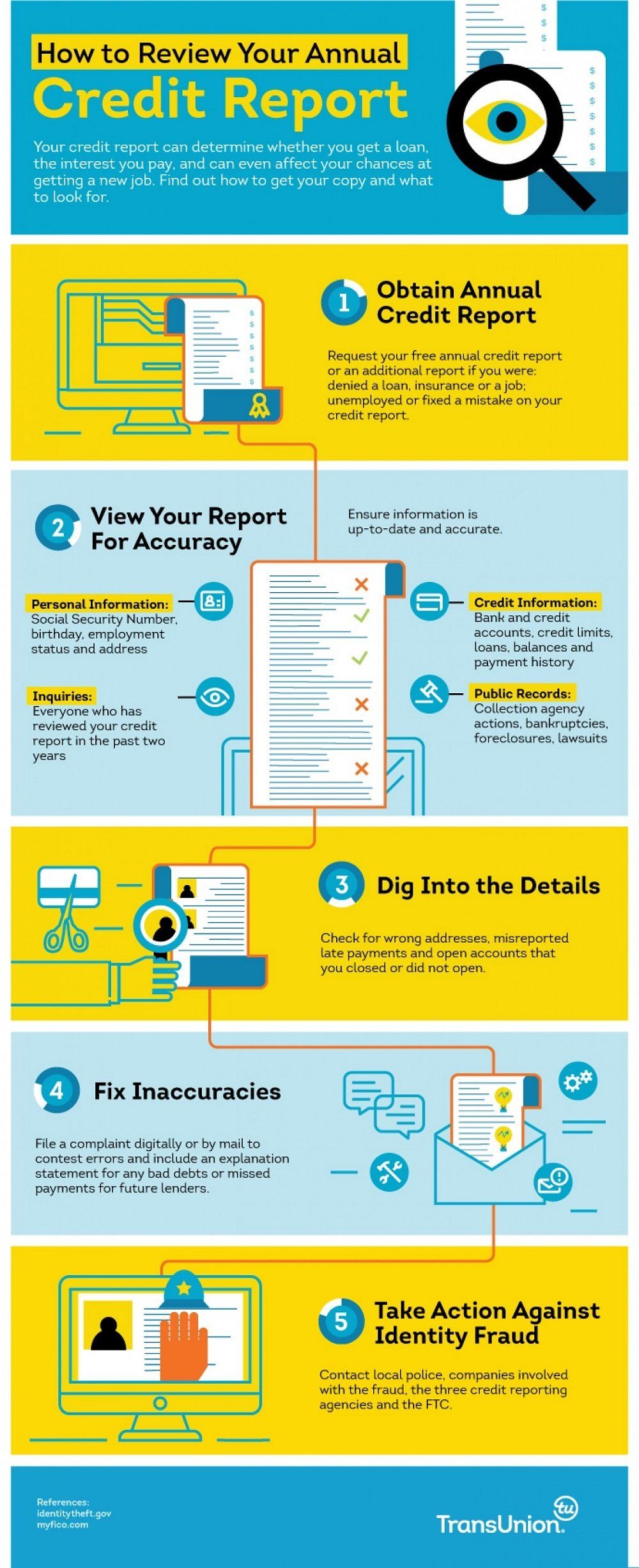

The “Big 3” credit bureaus (Experian, Equifax and TransUnion) maintain financial and personal records on more than 200 million American consumers. These bureaus merge data regarding a borrower’s historical transactions and payments with behavior analytics for certain types of debt. So they determine who is a good, mediocre or poor credit risk.

A credit report from these three credit bureaus can mean the difference in getting a job (or not) or receiving a security clearance (or not). And it’s probably the biggest factor in whether a consumer can purchase a home or a vehicle.

In addition to the Big 3, there are more than 400 regional or industry-specific credit bureaus across the U.S. These agencies provide specific information about everything from rental history, employment and medical debts. Every year, credit bureaus make an estimated 36 billion updates using data from 18,000 sources.

--Article Continues Below--

Use Responsibly

The power of credit reporting involves a concomitant responsibility. Reputable medical collectors, like CBSI, do not take this responsibility lightly.

At CBSI, we take care in the way we advise patients of the potential negative impact medical collections can have on their credit reports. And we will work with the patient/consumer to keep an overdue account from being reported to the credit bureaus, if at all possible.

Our mission is to help your patients pay their debts and get back on the road to a better credit rating.

Recent Posts

Share On: