Tax Refunds Help Pay Off Medical Debt

Encourage Your Patients to Use Their

Tax Refunds Wisely

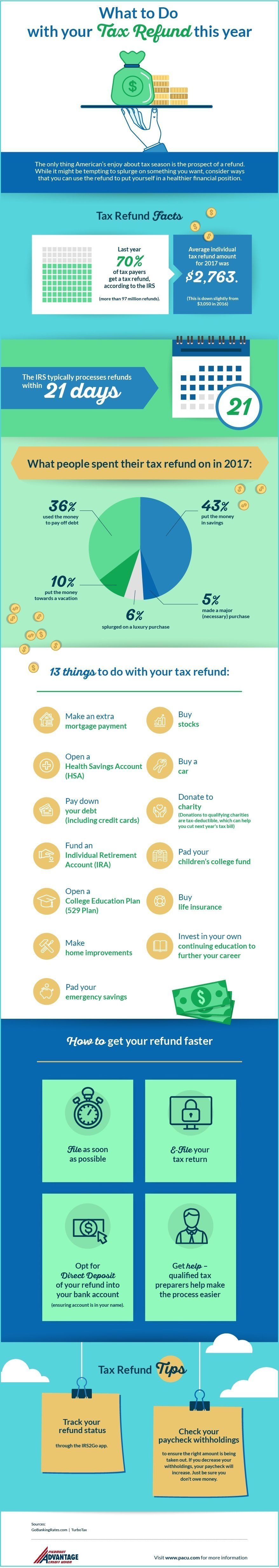

Do you know the average 2019 federal tax refund was more than $2,700? Your patients can use that money to improve their financial health by paying off medical debt.

In fact, that’s exactly what a lot of families do. According to a 2018 survey from JP Morgan and Chase Institute, the week after receiving a tax refund, healthcare spending overall increases 60 percent, and out-of-pocket healthcare spending on debit cards increases by 83 percent.

This increase in healthcare spending was particularly pronounced among the bank customers with the lowest checking account balances.

Ways to Spend It

But your patients may be tempted to spend their tax refunds in a myriad of other ways. While splurging on a new wardrobe or booking a cruise sounds like fun, it’s definitely not the wisest choice for those with medical debt.

You can encourage them to invest in their financial health instead. Here’s how:

- Remind them that using their refund to catch up on their debts can prevent damaging their credit score or – even worse –

becoming charge-offs.

- If their medical debt is more than the refund, help them work out a payment plan for the remainder, once the refund has been applied to the balance.

- If the tax refund comes close to covering the debt, be willing to negotiate a settlement by accepting the refund as payment in full. (Note: Make sure your patients are aware that the unpaid portion of the debt may be regarded as taxable income by the IRS.)

--Article Continues Below--

- Inform your patients that legal complications resulting from medical debt can severely impact their financial well-being. In fact, medical debt is the

leading cause of consumer bankruptcy.

- You may also suggest that they free up cash for medical bills by taking care of other debts. For instance, if they’re able to

settle credit card debt, they’d have extra money on hand to pay medical bills.

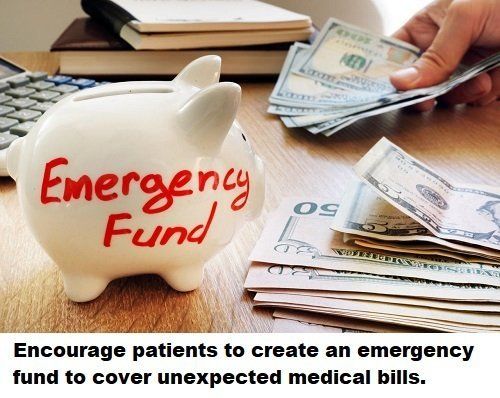

The All-Important Emergency Fund

Finally, to help your consumers avoid falling behind in the future, suggest they create an emergency savings fund. Setting aside even $500 or $1000 in a special savings account can provide a helpful buffer whenever unexpected medical bills pop up.

Most experts suggest that the equivalent of three to six months’ salary is ideal, but even a few hundred dollars in the emergency fund can save your patients from incurring medical debt in the future.

Once they’re no longer incurring medical debt, subsequent tax refunds can be used to build up this emergency fund.

For patients who are enrolled in a health plan with a deductible of at least $1,350 for an individual, you could also suggest that they open a Health Savings Account. HSAs are a tax-free way to help patients save for future qualified medical care.

Using their tax refunds to pay down medical debt may not elicit the same level of excitement as splurging on luxuries. But it can wisely position your consumers to reap financial benefits in both the short and long term.

Recent Posts

Share On: