What Goes on Inside a Debtor's Brain?

Understanding the Neuroscience of Debt

Debt changes the way our brains work.

Understanding the chemical reactions that take place in the consumer's brain -- before and after debt is incurred -- can benefit professional debt collectors.

Neurological Reasons for Incurring Debt

How do people get into debt in the first place?

According to noted science journalist Jonah Lehrer, the human brain is vulnerable to certain innate flaws. "These are the situations that cause the horses in the human mind to run wild, so that people gamble on slot machines and pick the wrong stocks and run up excessive credit card bills," Lehrer told

InsideARM.

Because the brain craves certain sensations and chemicals, it can compel certain behaviors (such as gambling or overspending) that produce these chemicals. In addition, consumers can subvert their brains' pain/reward response when they rely on credit instead of working hard to achieve a financial goal. Paying with plastic allows them to receive the reward first without the pain of hard work.

When credit is overused, the brain becomes confused, triggering a destructive loop of bad spending. Once this occurs, the ensuing financial stress hijacks neural pathways, rewiring consumers' minds in unexpected ways.

--Article Continues Below--

Impact of Financial Stress on the Brain

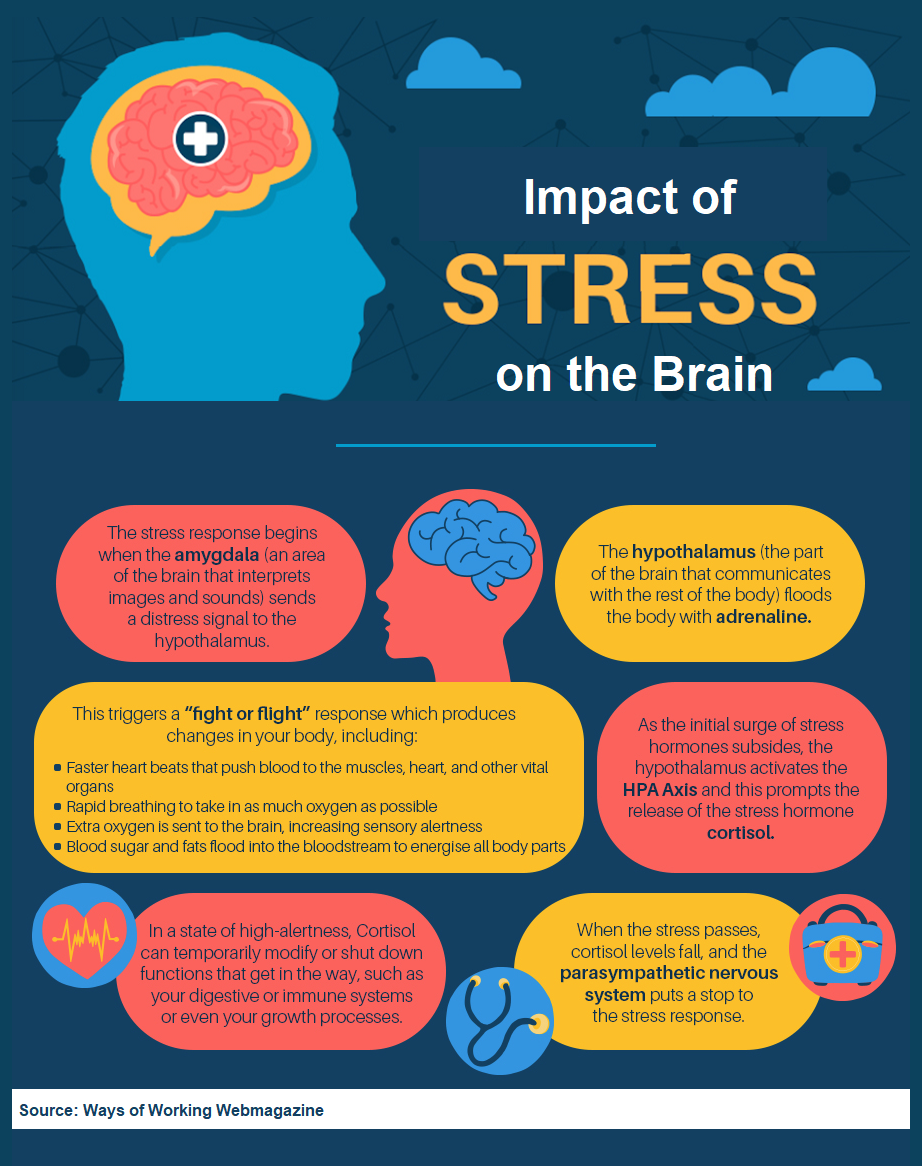

The brain perceives financial strain as a threat, stimulating a "fight or flight" response. The adrenal glands then pump out stress hormones adrenaline and cortisol, which induce physical reactions like increased heart rate, sweating, and anxiety.

If financial stress is prolonged, the area of the brain responsible for logical thinking (the prefrontal cortex) can be impaired. We become more reactive and less capable of managing situations. Strain also weakens the brain's primary memory hub (the hippocampus). The end result is difficulty concentrating and remembering important details that could help resolve our money troubles.

Take Back Your Brain

Consumers have the power to minimize the psychological and neurological impact of debt.

Here are a few strategies to help lower stress hormones and boost feel-good brain chemicals (like serotonin):

- Practice self-care through exercise, sleeping well, and limiting alcohol and caffeine intake.

- Challenge negative thoughts and reframe your situation more constructively.

- Set small, manageable goals to give yourself a sense of progress.

- Don't isolate yourself; seek others' input and support.

Overcoming debt and financial stress is difficult, but a more positive financial future is attainable with the right mindset and proper self-care.

Source: Neuro-Based Leadership Centre

The good news is that our brains are plastic and can rewire themselves. (See sidebar, "Taking Back Your Brain.”)

Attacking the Problem

Successful debt collection requires acknowledging that consumers often feel anxious, ashamed, and stuck. Empathy is essential from the get-go.

Validate the consumer's feelings. Then, help them understand how much better they'll feel once they have a repayment plan in place. With every payment made toward their goal, the consumer's brain will release dopamine, the reward chemical.

Because a consumer's willpower is exhaustible, encourage them to set up an automatic payment plan. If credit card debt is the problem, you could suggest they unsubscribe from store marketing emails and sales notification pop-ups to reduce temptation.

Finally, reframe the situation in the consumer's mind. Help them view their debt as a temporary condition that they have the power to remedy through a realistic repayment plan.

Survey Says...

In 2017, a curious Australian debt collector surveyed every consumer who paid in full within 24 hours of the account being sent to collections. He wanted to know what had changed for these people, since they clearly had had access to the funds all along.

Here are the results of the collector's unofficial survey:

- 62% said they didn't understand how serious the matter was until a collection agency contacted them.

- 22% said they forgot.

- 9% said they didn't want to part with the funds

- 7% said they had been waiting on money and always intended to pay after it arrived.

So, helping consumers understand the seriousness of their debt is key to getting paid.

At CBSI, our professionals are trained to recognize the influence of financial stress on a debtor's mind. We know that successful debt recovery requires a proper balance between patience and persistence.

If you're ready to let us carry the debt collection burden for you, we're ready, too.

Sources:

Featured Image: Adobe, License Granted

Trends in Cognitive Sciences

InsideARM

Brainz Magazine

Collect More Australia

Recent Posts

Share On: