How Professional Collectors Resolve Consumer Debt Disputes

Dispute Resolution

Requires Skill and Empathy

What should you do when a consumer disputes a debt? Should you allow a collection agency to handle the dispute or attempt to resolve it internally?

Some situations are best left to the professionals. Here's why: Reputable collection firms not only budget the time required to handle disputes, but they also extensively train their staff in best practices for dispute resolution.

Let's look at how professional debt collectors handle disputed accounts.

Walk a Mile in Their Shoes

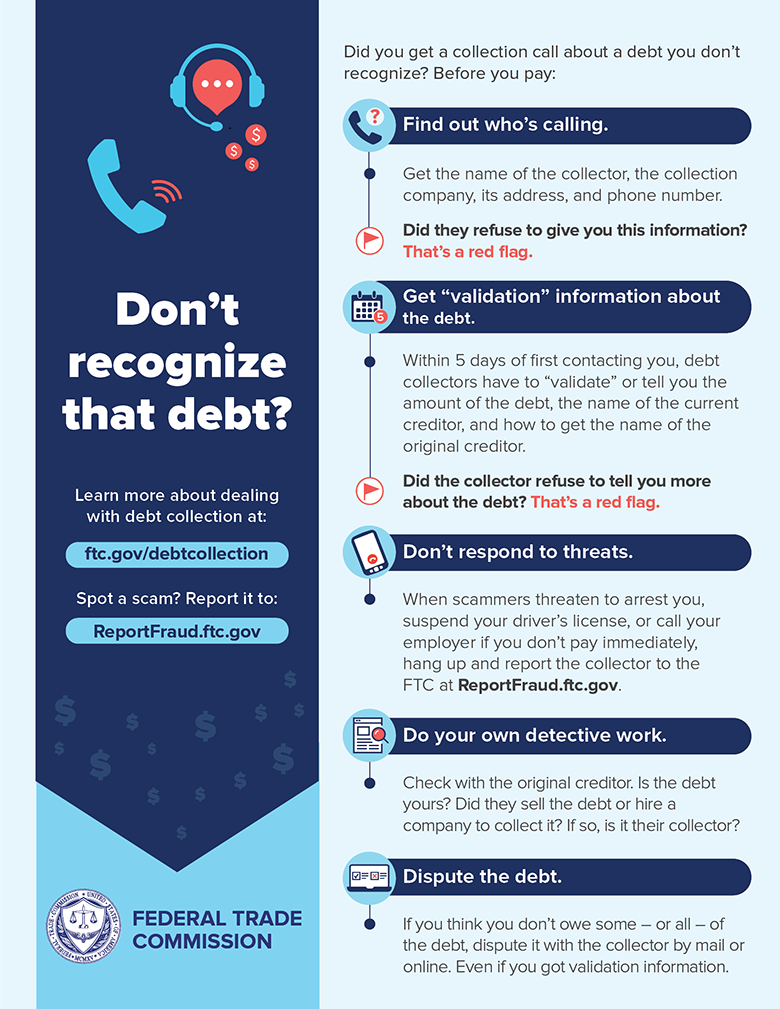

A reputable collection agency will err on the side of caution and take all potential disputes seriously. They'll place themselves in the consumer's shoes and treat them as they would want to be treated. And they'll treat all situations equally, even with little or no information.

Most agencies do not differentiate between written and verbal disputes. Therefore, to avoid the potential for legal issues, the best collectors will identify all types of consumer objections as "disputes." Doing so ensures that these situations are adequately addressed right from the start.

The infographic below illustrates the process consumers are advised to follow if they receive a call about a debt they do not recognize:

Resolution Process

Any disputed account, whether past due or not, requires the debt collector to obtain proper documentation from the client. This extra information is critical to helping the collection agent determine the dispute's legitimacy.

For instance, it's important to provide the collector with a copy of the bill when the account is placed. Doing so helps avoid confusion with the consumer and significantly speeds up the dispute process.

Whenever a collector and consumer can review the bill together over the phone, they can often clear up any confusion. Simply explaining the bill's details may be all that's required to resolve a debt.

If the disputed account is significantly past due and has already been placed in "collections," the agent should first confirm that the consumer received a Debt Validation Letter. (See sidebar, "About the Debt Validation Letter.”)

If the consumer's mailing address is incorrect, they may not have received this important notice within the specified validation period. If the consumer claims they never received the validation letter, a reputable collector will give the consumer the benefit of the doubt. This simple good-faith gesture can make the consumer more amenable to resolving the debt. The collector will then authorize the issue of a debt verification letter pursuant to Fair Debt Collection Practices Act (FDCPA) regulations.

When attempting to resolve the dispute, the collector must ask questions and listen attentively to find a solution. If communication with the consumer is clear and open, it's easier for the collector to pinpoint the issue that requires resolution.

From there, the collector can review alternatives based on common ground, and propose solutions. After the collector and the consumer agree upon a solution, both parties should commit to a resolution deadline.

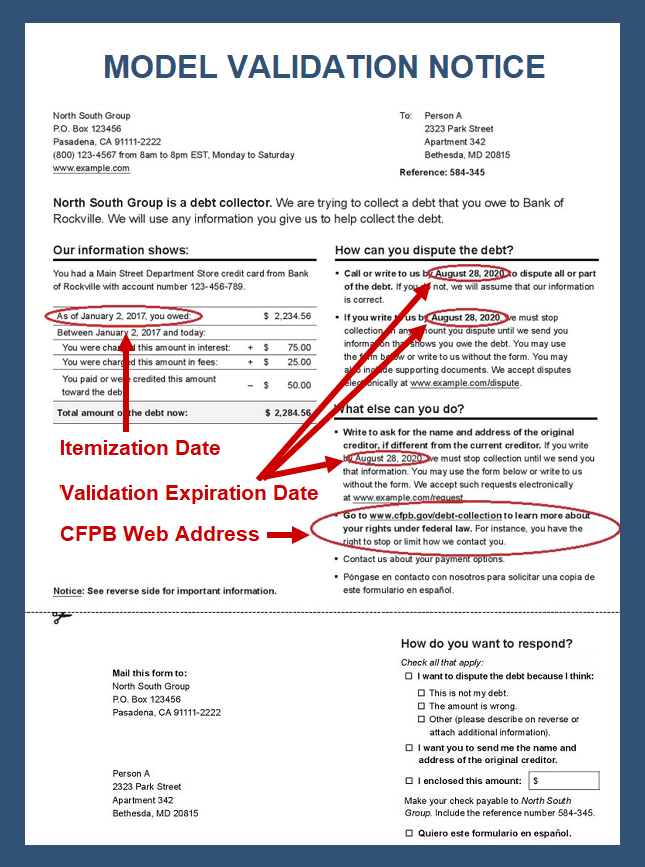

About the

Debt Validation Letter

The Debt Validation Letter must be sent within five (5) days of initiating contact with a consumer about his debt. With the adoption of Regulation F in November 2021, the Debt Validation Letter must now include the following information:

- The total amount owed.

- The name of the original creditor.

- A statement indicating that the collector assumes the debt to be valid unless the consumer disputes it before the expiration date specified in the letter (30 days after first contact).

- A statement indicating that the collector will verify the debt by mail if the consumer writes to dispute the debt or request more information before the 30-day expiration date specified in the letter.

- A statement indicating that the collector will provide the consumer with information about the original creditor if the consumer requests it prior to the 30-day expiration date specified in the letter.

- A statement indicating that the debtor may find additional information about consumer protections on the CFPB's website, and the website address must be included.

Client Communication

Reputable collection agencies will work directly with the client to resolve the dispute. Apprising creditors of a collection dispute as it unfolds can help them avoid similar situations and make collecting on future accounts easier for everyone.

Recent Posts

Share On: