Why You Need an Effective Collection Process

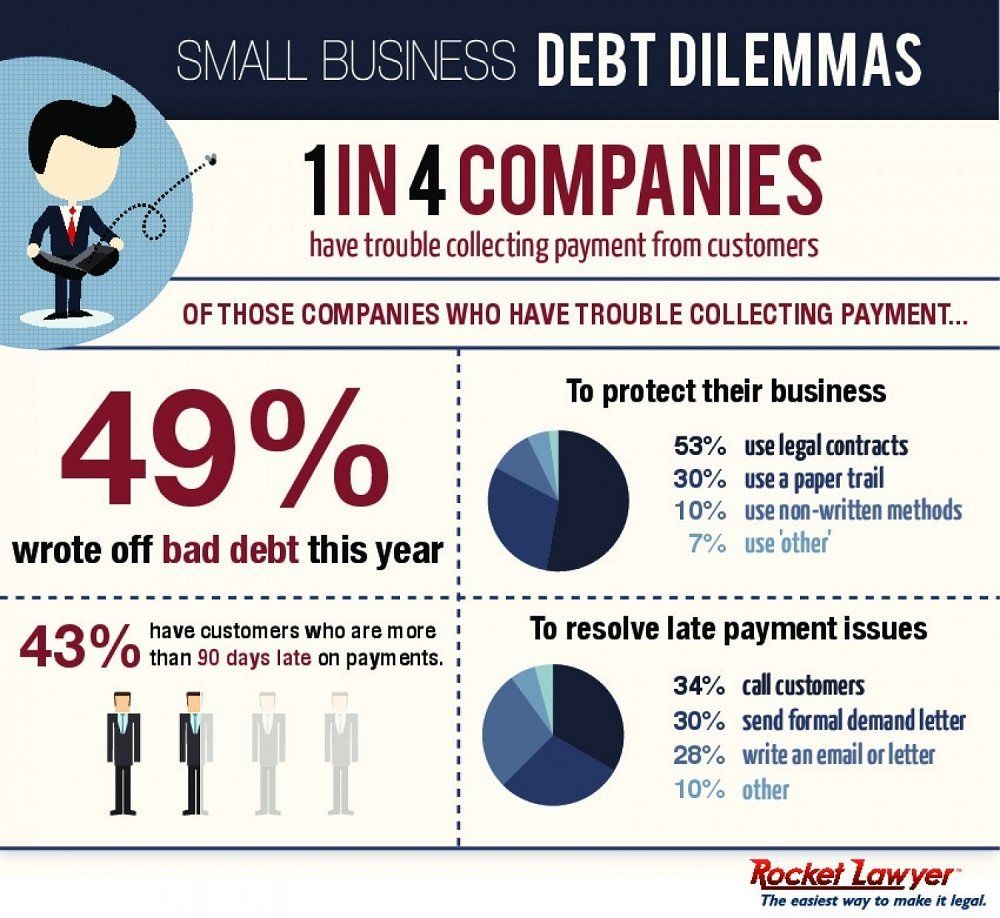

Did you know that ineffective debt collection is one of the primary reasons many businesses fail?

No doubt about it -- debt collection can be difficult for business owners. But it’s also critical to your company’s lifeblood: its cash flow. So having an effective collections process is key to keeping the revenue rolling in.

Since all businesses occasionally run into payment problems, it’s best to be prepared. By developing effective collection practices early on you can mitigate a host of headaches. And if you maintain those practices throughout the company, you’ll be able to spot problems before they become too big--or even prevent them altogether.

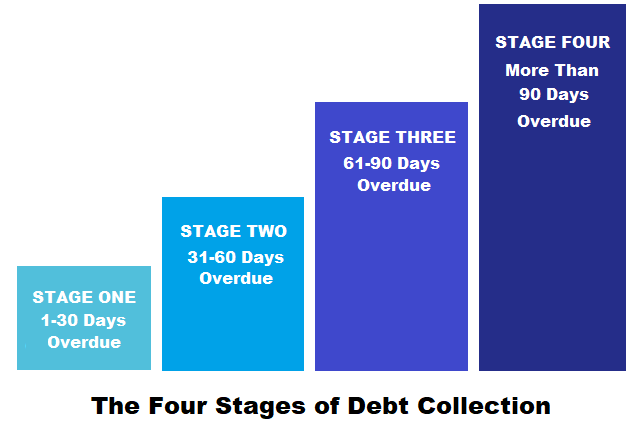

The first step is to accurately identify the stage of debt collection for each past-due account.

Stage One: 1-30 Days Overdue

Consumer satisfaction and payment education must be the focus of accounts in the earliest stage of delinquency. Using soft collection tactics at this point increases the chances of being paid quickly, without jeopardizing the consumer relationship.

When the debt is between one and 30 days overdue, you may be dealing with an accounting oversight or a minor cash-flow problem on the consumer’s part. Offering “friendly reminders” and maintaining open communication increases the odds that you'll be paid as quickly as possible.

Stage One does not typically require the help of a debt collection agency. But if you do choose to hire one at this point, you’ll want to ensure that the company approaches the consumer with friendly calls, emails and letters. Gentle reminders are best. You could also offer a payment arrangement.

Stage Two: 31-60 Days Overdue

After 31 to 60 days, you should step up your efforts. Continue with emails, letters and phone calls should, but they can be a bit more assertive in tone. You could also mention reports to credit bureaus, and begin tacking on late-payment fees.

At Stage Two, it’s also important to make sure your consumers know when their delinquency will trigger transferring the account to collections. Then offer an opportunity to work with them before the transfer occurs.

Stage Three: 61-90 Days Overdue

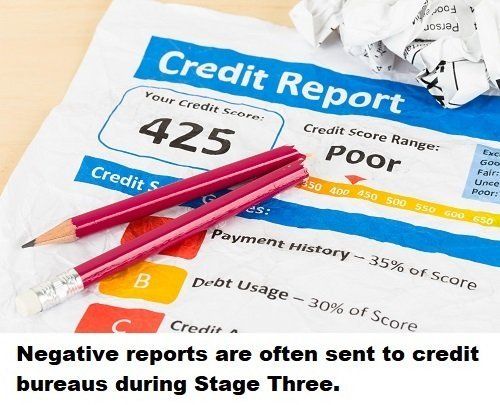

Phone calls, emails and letters increase in frequency during Stage Three. They may include the threat of legal action. At this point, you may wish to place a hold on the consumer's credit. Let them know that a negative report is being sent to credit bureaus, and that late fees and interest are accruing.

Stage Four: More Than 90 Days Overdue

If they haven’t already done so, most businesses will enlist the help of a debt collection service once the account is more than 90 days overdue. This is the most serious of the four debt collection stages. It’s time to bring in the “big guns” in order to get your invoices paid.

When choosing a third-party collection service, be sure to select one that moves properly through the various stages of collection--beginning with friendly reminders and gradually increasing to firmer tactics. Your consumers will know they’re being respected, you’ll have a higher revenue recovery rate, and you’ll still retain those consumers who just had a temporary cash-flow problem.

--Article Continues Below--

Dispute Resolution

Because disputes can arise at any point in the various stages of debt collection, you’ll want to have an established dispute resolution process to handle such matters.

However, this process will differ, depending on the type of dispute. For example, you wouldn’t want to treat billing disputes the same way you’d treat technical disputes. That’s why you might want to designate specific staff members for each dispute type.

Other disputes could pertain to:

- The quality of goods or services.

- A differential between the price charged and the one negotiated by the consumer.

- Administrative issues, such as missing or poorly written invoices, purchase orders, etc.

- Missing goods, or any difference between what was billed and what was received.

Regardless of the type of dispute, you’ll want to establish a timeline for resolution. For instance, a simple price dispute could probably be resolved within a few days, whereas a quality issue could be more complicated and take several months to settle. All interested parties should be aware of the established time line.

Per the Fair Debt Collection Practices Act (FDCPA) all debt collection activities are suspended during the dispute resolution process. After the dispute has been resolved, normal collection can resume, this time with a new due date based on the date of resolution.

Recent Posts

Share On: