Three Doable New Year’s Resolutions

How to Attain Your Goals

Through Baby Steps

Did you know that most Americans abandon their New Year’s resolutions within the first month?

And less than ten percent see their resolutions through to completion.

If your resolve begins to wane as February approaches, perhaps it’s time to reassess your goals. Let’s look at ways to make three of the most common resolutions more doable.

Slim Chances

When setting weight-loss goals, many of us bite off more than we can chew (if you’ll excuse the pun). Losing 50 or 80 pounds over the course of a year is reasonable and highly doable; losing it within a couple of months is not—if you want to remain healthy.

If you dive into an aggressive weight-loss program without the proper motivation, you’re setting yourself up for early failure. Try to look at the long-term picture and focus on getting a little bit healthier every day.

Regional Resolutions

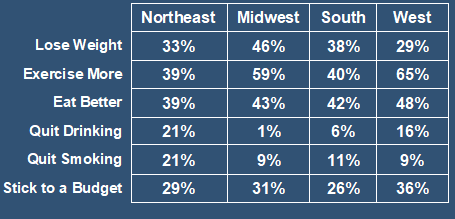

A recent YouGov survey of past New Year’s resolutions reveals some interesting regional differences.

For instance, Midwesterners are the most concerned about losing weight (46%) and the least concerned with quitting alcohol (1%). Here’s how the stats line up for the most popular resolutions:

Source: YouGov

For instance, eliminating all processed foods from your diet may not be doable, but restricting them certainly is. Here are some small changes that can make a big difference:

- If soft drinks are your weakness, try switching up to flavored, unsweetened sparkling water and save the Pepsi for special occasions only. (Even so-called “diet” sodas have been shown to cause weight gain.)

- Do you crave the crunch of potato chips or high-carb crackers? Reach for an apple or a handful of lightly salted nuts instead.

- If chocolate is your thing, opt for a small amount of dark chocolate with at least 70% cocoa content. Milk chocolate contains the wrong kinds of fat, twice as much sugar, and less than a third of the fiber found in its darker cousin.

- Choose whole-wheat pasta; it’s more filling than conventional pasta, and you’ll eat less.

- Wherever possible, add more vegetables to your meals. Their natural fiber will make you feel full and help curb the tendency to snack. (Not a vegetable lover? Try cauliflower “mashed potatoes.”)

A realistic program for permanent weight loss involves baby steps. Aim for losing 1 to 2 pounds per week.

No Pain, No Gain

According to the most recent Forbes Health/OnePoll survey, getting in shape is the #1 New Year’s resolution for 2024. It doesn’t have to entail a gym membership — although it certainly can! Any activity that gets your body moving will be an improvement.

If you’ve been sedentary for years, get approval from your doctor before embarking on an exercise regimen. (See “The Exercise Prescription.”) Then, invest in a good pair of walking shoes that provide the proper support. The benefits of walking are manifold: lower body fat and improved circulation, joint health, bone density, blood pressure, and mood.

Begin by walking just 10 minutes a day at a comfortably brisk pace. (A good gauge is you can talk but not sing.) Do this for one week, allowing one day for rest or mild strength training (such as squats). For Week 2, repeat the regimen, but increase your walking time to 15 minutes per day. Increase your walking time by 5 minutes each week. By Week 5, you’ll be walking 30 minutes daily, six days a week -- the recommended amount of daily aerobic exercise for optimal health.

Here are a few more suggestions to keep your exercise program on track:

- If you happen to have at-home fitness equipment, it’s time to use it for something besides a clothes hanger. It will help you incorporate exercise into your daily routine (e.g., walking on a treadmill while watching your favorite program or reading while riding a stationary bike).

- Some people feel more motivated to exercise with a friend. If you’re one of them, ask a buddy to meet you for a scenic walk or to join a water aerobics class.

- Set a workout milestone, such as walking for two weeks in a row, and then reward yourself with a massage or a new article of clothing when you meet it.

- Don’t punish yourself if you miss a workout. Instead, consider it a rest day, and remember there’s always tomorrow.

The Buck Stops Here

If one of your New Year’s resolutions is to get out of debt in 2024, there are several baby steps you can take to achieve your goal. The key is to stop creating new debts until the old ones have been satisfied. (Some debts, like medical bills, may be unavoidable, but you can at least have a plan to pay them off before incurring new credit card debt, for instance.)

Once you’ve stopped incurring new debt, make a list of all your debts, from smallest to largest. This means gathering all your bank statements, credit card statements, and any correspondence from creditors. Include interest rates in your calculations, as these can change your monthly figures.

Pay off the smallest balance first. This practice, called the snowball method, was first popularized by financial expert Dave Ramsey. It will give you the motivation and momentum to tackle the larger debts. (For details, see the infographic below.)

Work on cutting your expenses. For instance:

--Article Continues Below--

- Review your auto insurance annually, comparing quotes online. Consider increasing your deductible or eliminating collision coverage for an older vehicle.

- Check with your local library to see if they offer free access to online entertainment like Libby, Kanopy, or Hoopla Digital, so you can eliminate online streaming fees.

- Prepare meals at home instead of eating out (Even fast food is more expensive than home cooking.) You can stretch your food budget by purchasing produce in season, store brands, and items with longer shelf life.

- Reduce your energy bills by adjusting your thermostat, taking shorter showers, setting your refrigerator to 37 degrees and your freezer to 0 degrees, washing clothes in warm or cold water, and using smart power strips.

Paying off your debt may seem nearly impossible, but it’s highly doable if you take baby steps.

Sources:

Featured Image: Adobe, License Granted

Recent Posts

Share On: